In this article we are going to talk about the history of technical analysis, candlesticks, and its founders.

Traders and investors who use a modern approach to Technical Analysis would be very surprised to know how ancient it is.

The candlesticks we use today, was invented about 250 years ago, in Japan, during feudal era (I told you it is old!). The history of Technical Analysis is very interesting, and I hope you will enjoy this article!

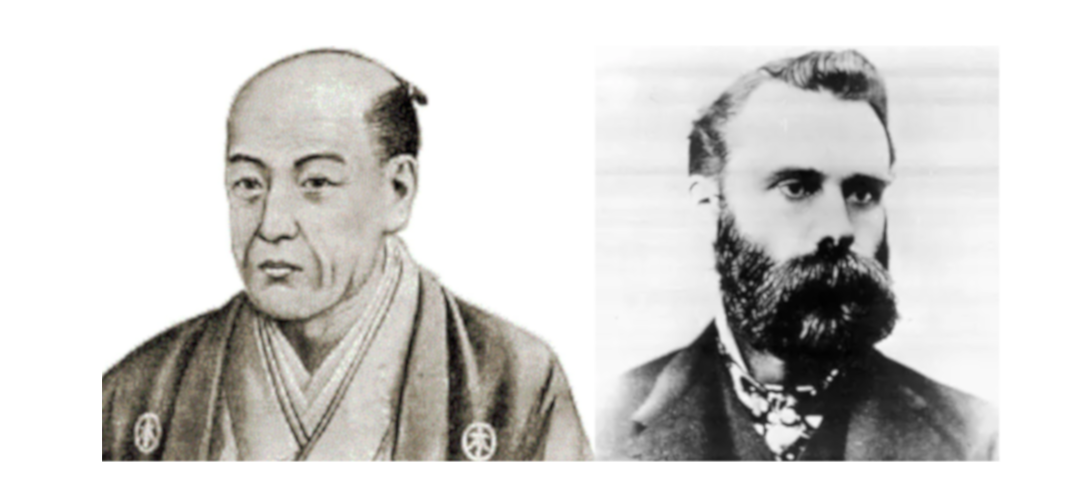

THE GOD OF TRADING

The candlesticks were created by a man called Munehisa Homma, a samurai trader who is known to be the “god of trading”. He became a very powerful man, with a huge fortune that he earned trading rice futures in Osaka’s market. And most interesting of all, he wrote a book, “The Fountain of Gold – The Three Monkey Record of Money”.

Homma wrote his book in 1755 and is the first book on market psychology.

Do you remember in my first article, when I said technical analysis is about reading the market’s psychology? Here’s why: Homma developed a method to interpret the mood and behavior of the market – the candlesticks.

Also, that’s why most of the candlesticks patterns we know have this battlefield background in their names, like: Piercing line, three white soldiers, two mountains, dark cloud cover, hanging man, etc.

Candlesticks have a strong military background. This is interesting because in order to become a successful trader or investor, you must possess some military qualities, like discipline, focus and cold blood.

THE TECHNICAL ANALYSIS’S FATHER

Charles Dow was a journalist born in 1851, and he founded one of the most respected financial publications in the world: The Wall Street Journal.

Also, you must have heard about the Dow Jones Industrial Average – yes, that’s because of him too.

But what we are going to discuss here is his contribution to technical analysis. He developed a series of principles to understand and analyze the market psychology and behavior. Which would become the Dow Theory, the groundwork for technical analysis. And that’s why he is the father!

You can find more details about the Dow Theory here.

Charles Dow developed a way to understand the mood of millions of players in the market, and how to understand what drives us to behave the way we do.

That’s why technical analysis is not about predicting. To be honest with you, I only started making money in the market the moment I stopped trying to predict things and see what the market was really doing, instead of what I expected.

But you might be asking, why does TA still work, even being such an ancient tool to use? Because what the candlesticks and the charts reveal to you are about human nature, and that is something that we cannot change even in 2 or 3 centuries.

That’s why it still works and that’s why you should use it to sharpen your investor’s skills.

In the next part I’ll explain a little about the way I like to use TA, so, stick around!